South African motorists who drive with expired driving licence cards after the renewal grace period lapses on 15 April 2022 will not have their insurance claims rejected outright.

That is according to an insurance expert who recently spoke to CapeTalk about how an expired driver’s licence card affects car cover policies.

Under normal circumstances, the failure to drive with a valid driver’s licence card could impact the approval of a car insurance claim.

But founder and CEO of insurance underwriter manager Ami Sure, Christelle Colman, said that many insurance companies had extended their grace periods covering driving with an expired licence until September 2022.

“With the most recent situation, most of the large insurers have come out and said they will be extending their own grace period until the end of September 2022,” Colman explained.

The comment comes after the Automobile Association (AA) cautioned that insurers could repudiate more accident claims where motorists drive with expired licence cards.

While transport minister Fikile Mbalula heeded the AA’s call for an extension, the grace period deadline was only delayed by two weeks, to 15 April 2022.

That is precious little time to clear a backlog that Outa has estimated to be around 1 million.

The department previously extended the grace period to renew driver’s licence cards that expired between 26 March 2020 and 31 August 2021 to 31 March 2022.

That was intended to allow the Road Traffic Management Corporation (RTMC) to catch up with a backlog of 1.2 million renewals, brought on by corruption at driver licence testing centres and the Covid-19 pandemic.

But the grace period has ostensibly done little to solve that backlog, particularly since South Africa’s single driving licence card printer was broken down from early November 2021 to late January 2022.

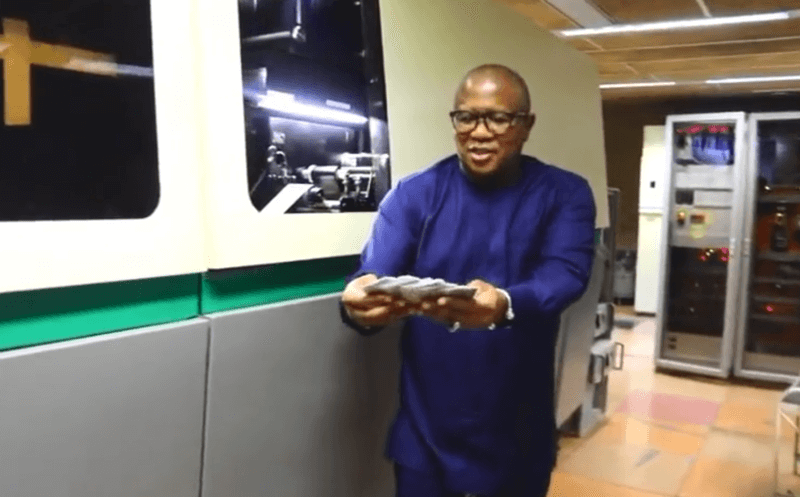

Transport minister Fikile Mbalula visited the DLCA in January 2022, following the printing machine’s return to operation.

Transport minister Fikile Mbalula visited the DLCA in January 2022, following the printing machine’s return to operation.

Colman said insurers had been accommodating since the advent of the renewal crisis.

“Right from the get-go, the insurance industry, to a very large extent, has been making its own exceptions,” Colman said.

But Colman advised motorists who were still concerned to call or email their insurer or broker to confirm the state of their coverage under an expired licence.

Motorists must then communicate their specific situation around the renewal and ask how this would affect their insurance.

“Make sure that you do everything in your power to be in the best position possible,” Colman stated.

“Go and renew your licence. Even if you haven’t received it, you will have proof that you attempted to do that. And make sure that you manage your own risk as effectively as possible.”

While insurance companies will be taking different approaches, Colman said the industry generally wanted to treat policyholders fairly.

There might be some situations where the insurer determined the expiration of the licence card was a material component in the accident.

“If you are involved in an accident, you haven’t attempted to renew your driver’s licence in the last year, and you were driving recklessly, then it is material to the loss, and the claim might be rejected,” she warned.

Content retrieved from: https://mybroadband.co.za/news/motoring/439486-what-driving-with-an-expired-drivers-licence-card-means-for-your-insurance.html.